News

- markets

- news

- 3 hours

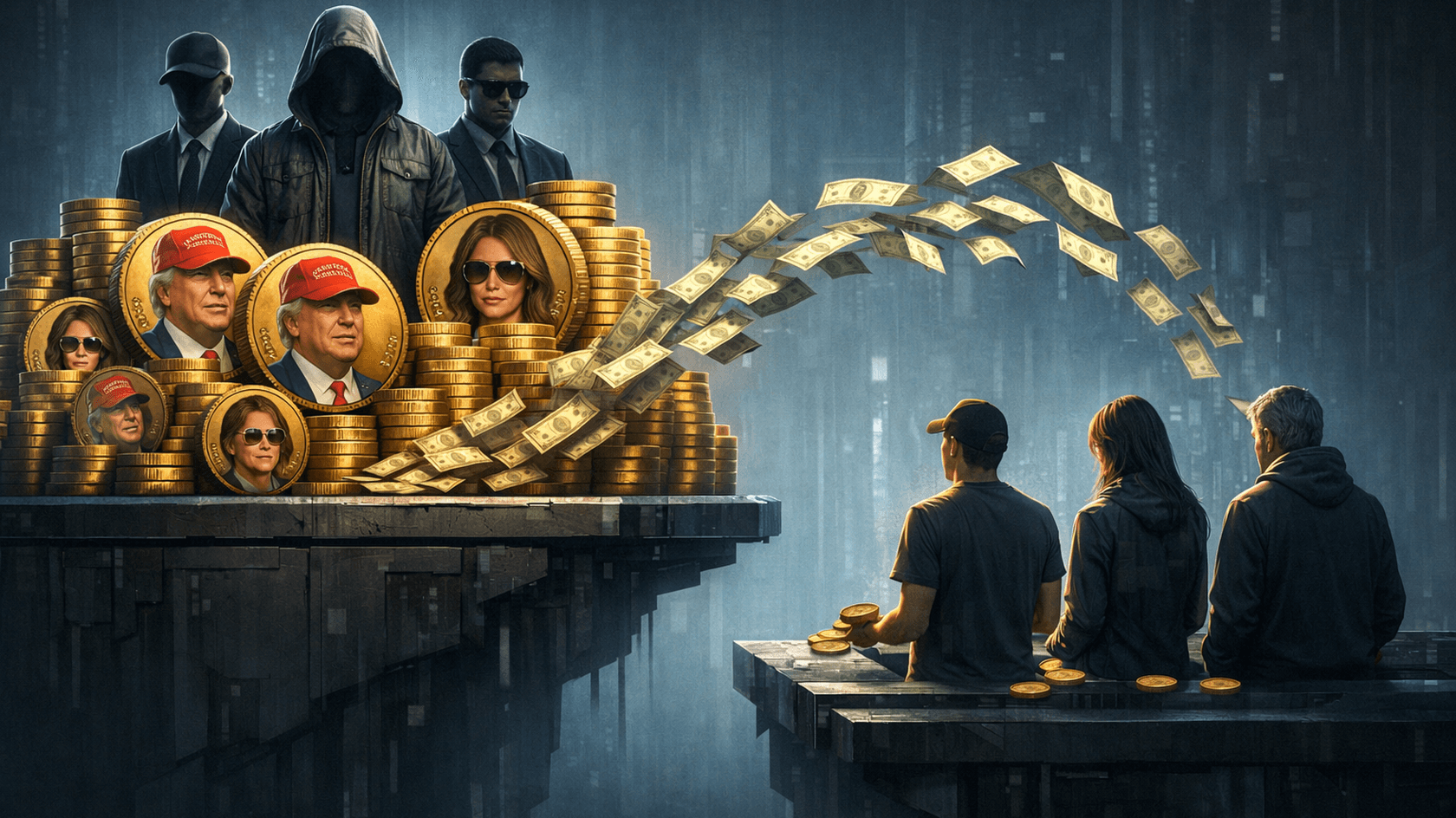

Insiders Made Millions on the Crash of Trumps’ Memecoins

Retail Investors Became Exit Liquidity for Insiders, Whose Massive Token Sell-Off Wipes Out Millions of Wallets

0

- markets

- news

- 12 hours

DeFi Analytics Terminal Parsec Shuts Down After Five Years of Operation

The team behind the popular trading service ceased support for the project due to an inability to adapt to new on-chain trends.

0

- ai

- news

- 14 hours

Vitalik Buterin Advocates for Human-AI Synergy Instead of Full Autonomy

The Ethereum co-founder stated that the self-sovereign AI concept amplifies risks while steering the industry away from tasks beneficial to humans.

0

- regulation

- news

- 16 hours

Ripple CEO: The Clarity Act Could Be Passed As Early As April

New Rules For Oversight Of The Crypto Sector In The U.S. Market May Come Into Force This Spring.

0

- ai

- news

- 19 Feb 26

Algorithm Vulnerability Allowed Manipulation of Neural Network Responses: Hack Took Twenty Minutes

A simple fake publication forced the world's leading language models to present fabricated information as a verified fact.

0

- security

- news

- 19 Feb 26

Hacker Returns Stolen Bitcoin Worth 40 B Won to Prosecutors

South Korean law enforcement recorded an unexpected return of lost crypto assets to government accounts.

0

- markets

- news

- 19 Feb 26

Ethereum Developers Reveal Blockchain Scaling Plans for 2026

The Foundation reorganized protocol work to implement native account abstraction, boost censorship resistance, and prepare for quantum threats.

0

- markets

- news

- 19 Feb 26

World Liberty Financial Tokenizes Credit Revenue of Trump Maldives Resort

Investors gain direct on-chain access to luxury real estate yields through a decentralized infrastructure.

0

- markets

- ecosystems

- news

- 18 Feb 26

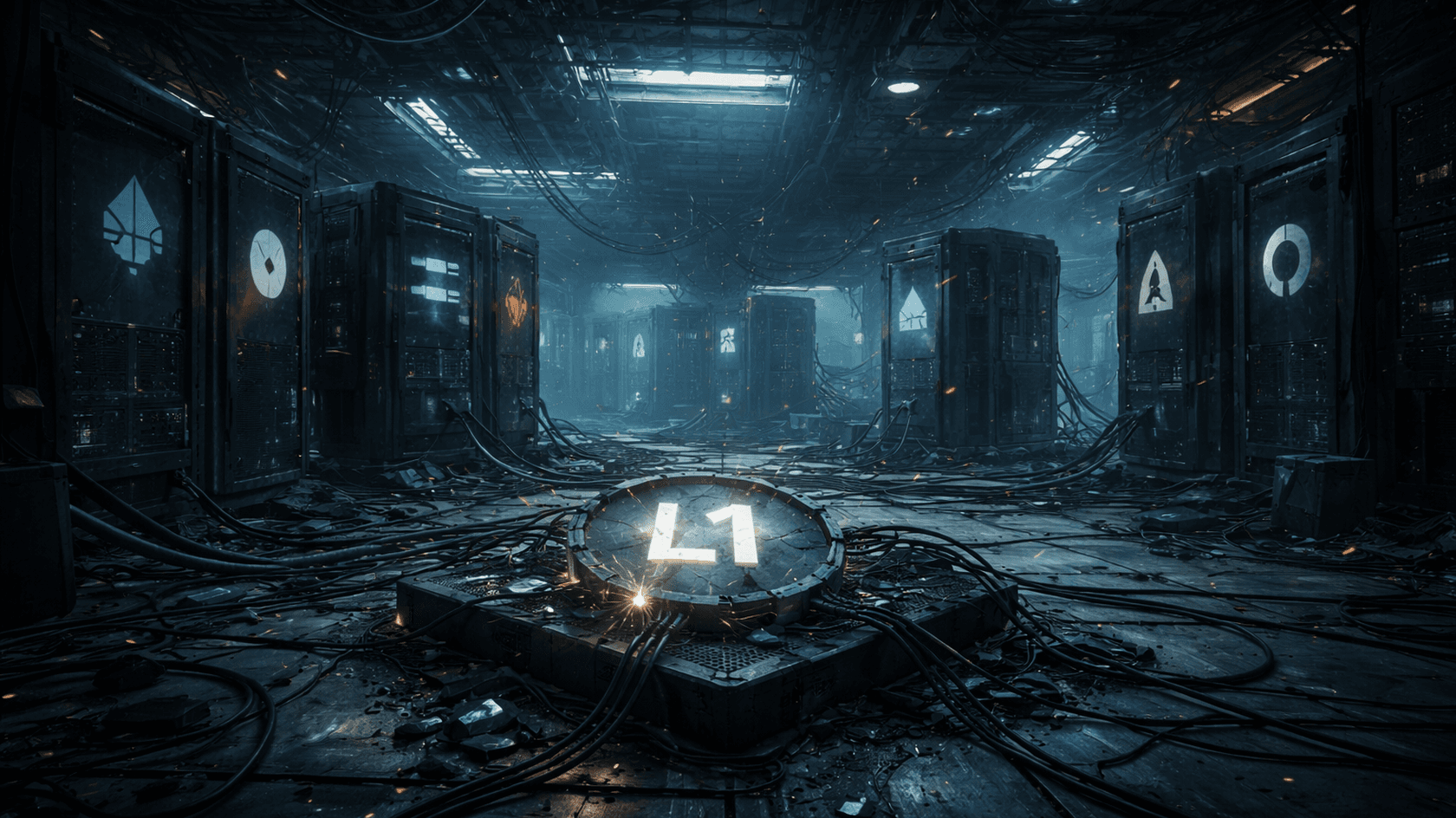

The Era Of Universal L1 Blockchains Has Come To An End, Analysts Say

The base-layer blockchain market has reached a point of saturation and no longer needs ambitious new networks without a clear specialization.

0

- nft

- markets

- news

- 18 Feb 26

Shib Team Releases NFT to Compensate Community Losses

Developers Introduce On-Chain Audience Support Tool With Unconventional Asset Splitting Mechanism

0