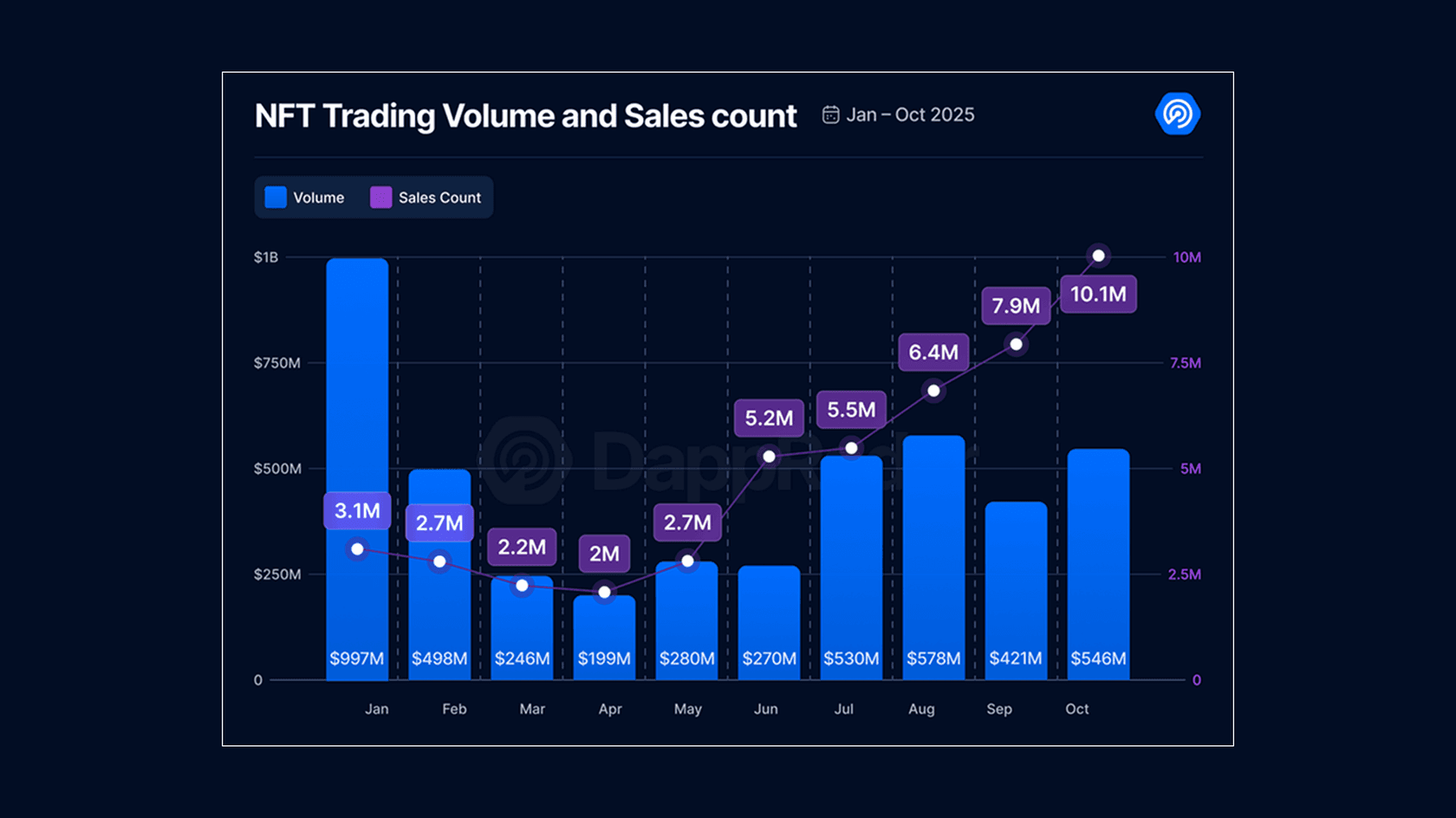

According to DappRadar’s latest report, the NFT sector became the main growth driver of October, marking the most active month of 2025. Trading volume rose 30% to $546M, while the number of transactions reached a yearly high of 10,1M.

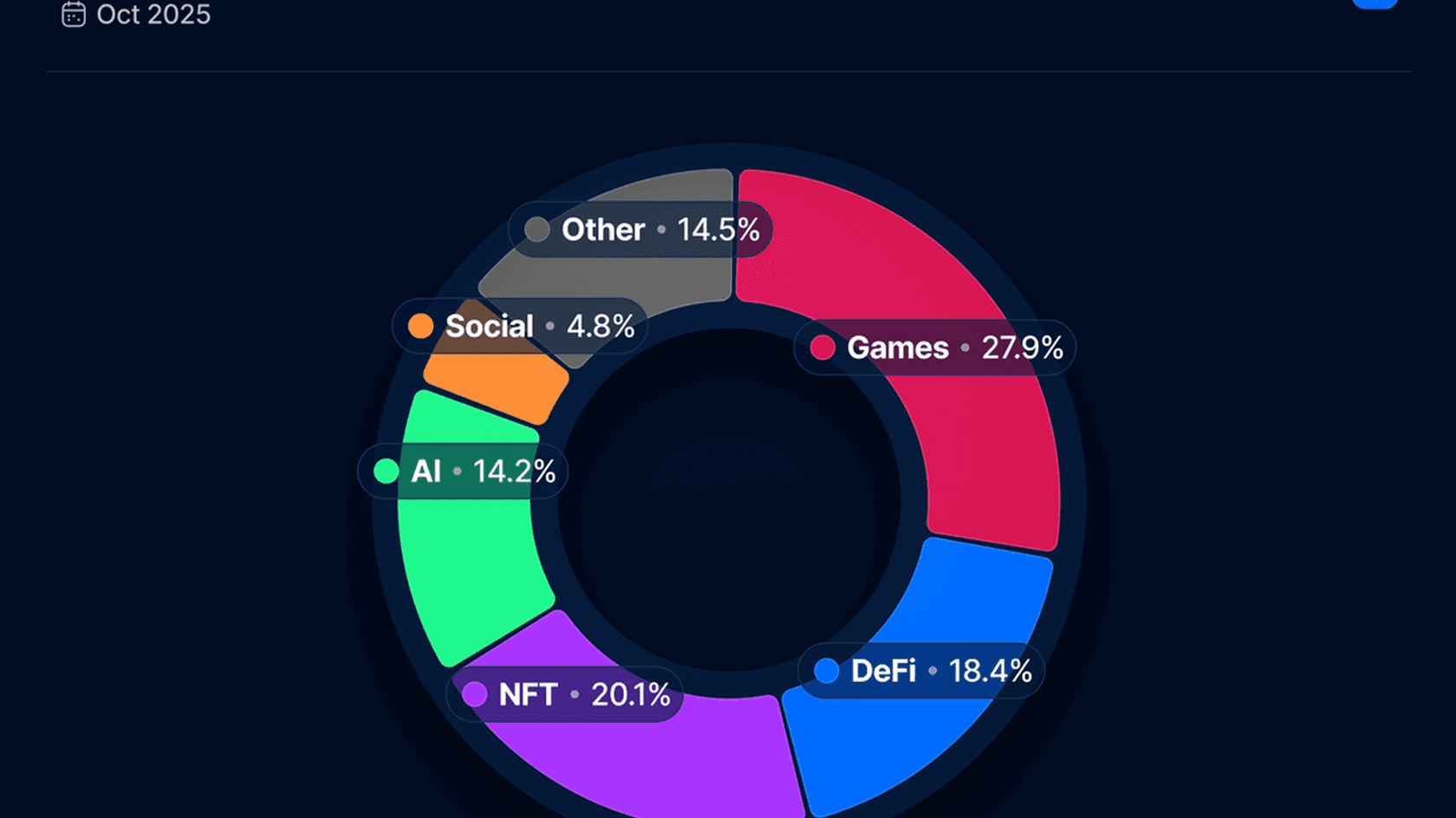

As prices fell, NFTs became more accessible for newcomers, and the ecosystem shifted toward utility-focused use cases and branded collaborations. Meanwhile, gaming dApps strengthened their dominance as the DeFi sector came under pressure from policy and macroeconomic factors.

Key NFT Metrics and Drivers in October

Analysts reported that the average NFT price dropped from $321 in January to $54 in October, making the market six times cheaper to enter. The month recorded 820,945 traders – up 1% from September – with each user averaging around 12 sales.

By network, Ethereum led with $263 M in trading volume, while Base climbed to $88 M, surpassing Solana and Polygon thanks to its low entry threshold and airdrop expectations. Among collections, DX Terminal rose to second place by volume, overtaking BAYC, while Courtyard gained momentum through its anti-fraud model for physical goods and verified card buybacks.