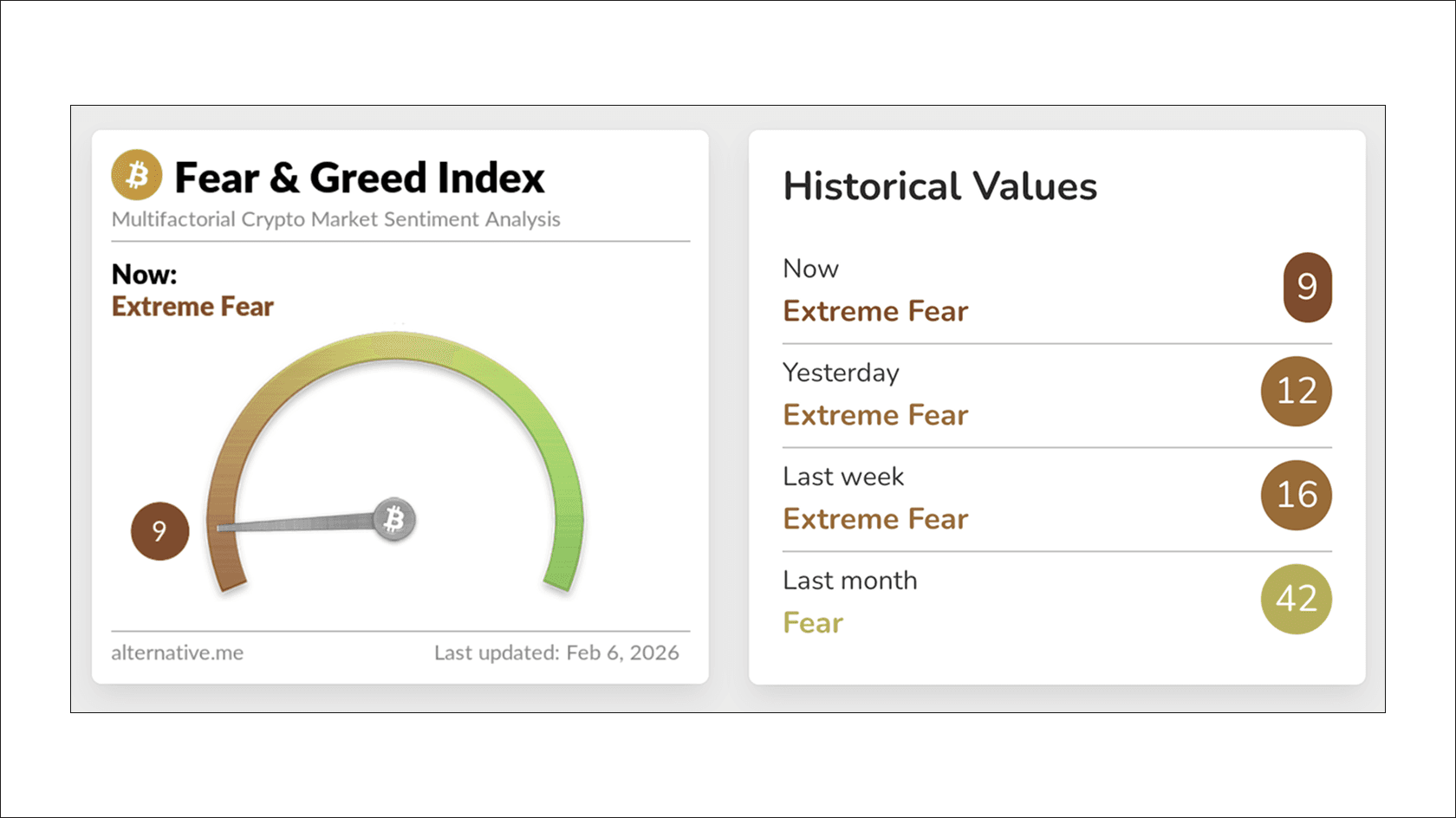

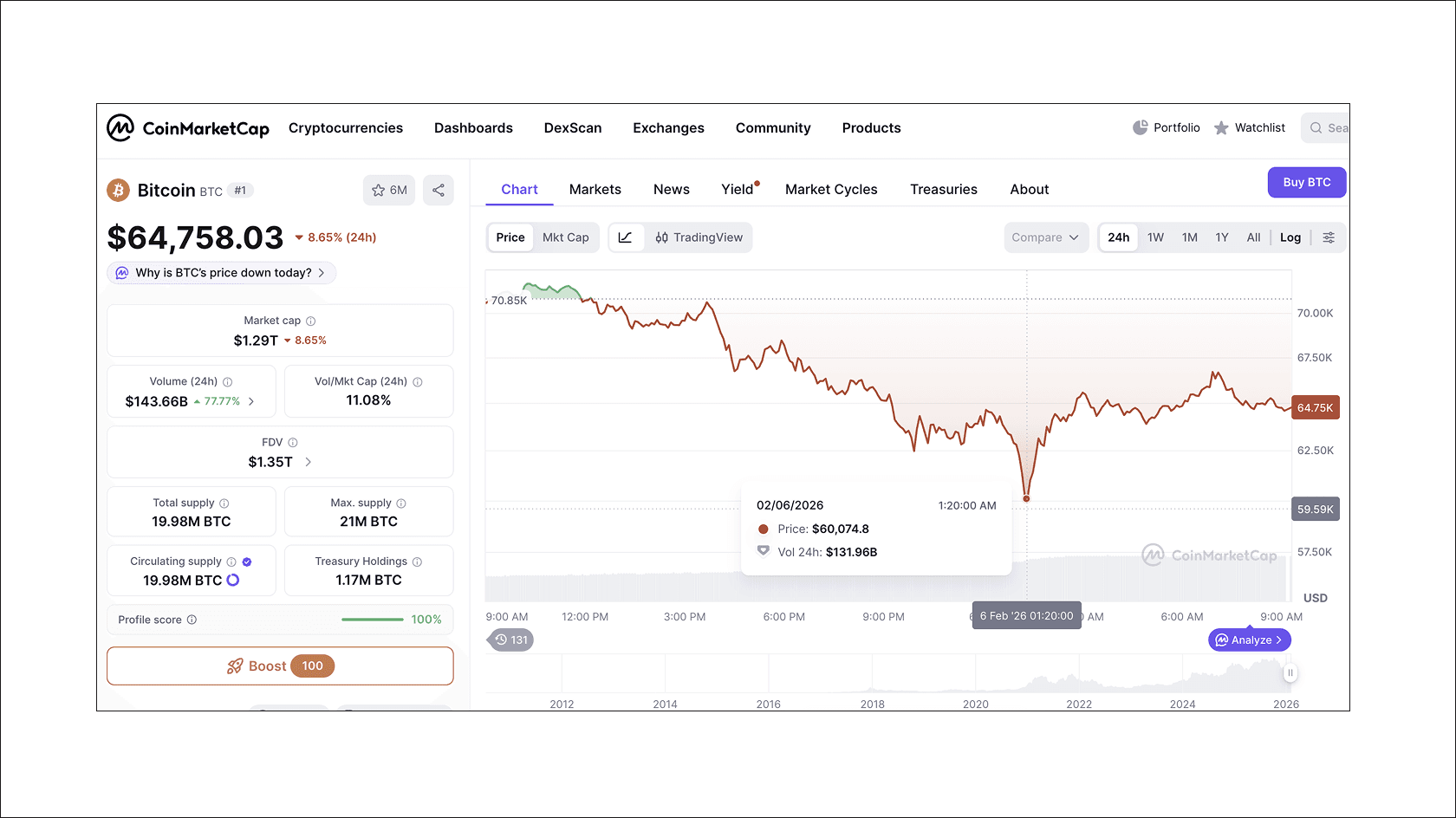

Friday morning began with a rude awakening for traders: Bitcoin’s price dipped to $60,000. The Fear and Greed Index reacted instantly, plummeting to 9 out of 100.

- markets

- news

- 06 Feb 26

Bitcoin Finds a Bottom Near $60,000 Amid Record Investor Fear

Panic comparable in scale to the 2022 Terra ecosystem collapse has gripped the cryptocurrency market. Investors are watching in horror as the leading coin sheds thousands of dollars in mere hours.

0

- rating +26

- subscribers 113

The industry hasn’t seen such gloomy sentiment in over three years. In just three weeks, Bitcoin has lost 38% of its value, pulling back from highs and effectively erasing all profits holders made over the last 18 months.

Market Crash, Billions of Dollars Burned in 24 Hours

The coin is now attempting to consolidate above $64,000 following a 13% daily drop. A historic moment was recorded: for the first time in a long while, Bitcoin fell below the 200-week Exponential Moving Average (EMA). The crypto community views this indicator as the watershed between a local correction and a deep bear market.

The drop triggered a domino effect across exchanges. According to CoinGlass, over 588,000 traders faced liquidation in the last 24 hours. Total losses amounted to $2.7 B. The main blow hit those betting on growth and trading with leverage — they accounted for 85% of all forced closures.

Why the Market Is Plummeting

Investors have started a mass exodus from risk assets, fearing a bursting bubble in the AI and neural network sector. Even giants like Amazon are losing 10% following quarterly reports. Against this backdrop, the thesis of Bitcoin as “digital gold” has once again come into question.

Analysts note that rising unemployment has spooked the market. Bad news from the real economy is forcing the Fed to remain cautious about rate cuts. Consequently, traders prefer to move to cash rather than wait for the situation to deteriorate further.

Read also:

- Strategy Ready To Withstand A 90% Bitcoin Drop — Michael Saylor

- CryptoQuant: Bitcoin Might Get Stuck In The $60,000 – $80,000 Corridor If The Fed Doesn't Cut Rates

- VanEck Analyst Estimates Bitcoin Could Reach $644,000 by 2028

- $19 Billion in Liquidations in 24 Hours: Crypto Market Endures a Day of Chaos, Binance Prepares Record Payouts

This post is for informational purposes only and does not constitute advertising or investment advice. Please do your own research before making any decisions.

0