According to CryptoQuant analysts, the world’s largest crypto exchange closes 2025 at all-time highs across all key centralized finance metrics. The gap between the market leader and other participants has widened significantly, cementing the platform’s status as the primary liquidity hub of the current bull cycle.

- ecosystems

- news

- 17 Dec 25

Binance Dominates 2025 Market Liquidity — CryptoQuant

Spot volume exceeded the nearest rival fivefold, while derivatives doubled OKX figures amid record capital inflows.

0

- rating +26

- subscribers 113

Binance spot trading volume approached the $7 T mark in 2025. This figure shattered the 2024 record and stood five times higher than the results of its closest competitor, Bybit.

Heavy capital inflows and high retail activity fueled this growth. The number of executed spot trades reached 24.1 B, marking a 4% increase year-over-year and exceeding 2022 levels by three times.

The perpetual futures sector also saw explosive growth. Trading volume here hit $24.6 T. The nearest rival in the derivatives segment, OKX, trails this metric by more than half.

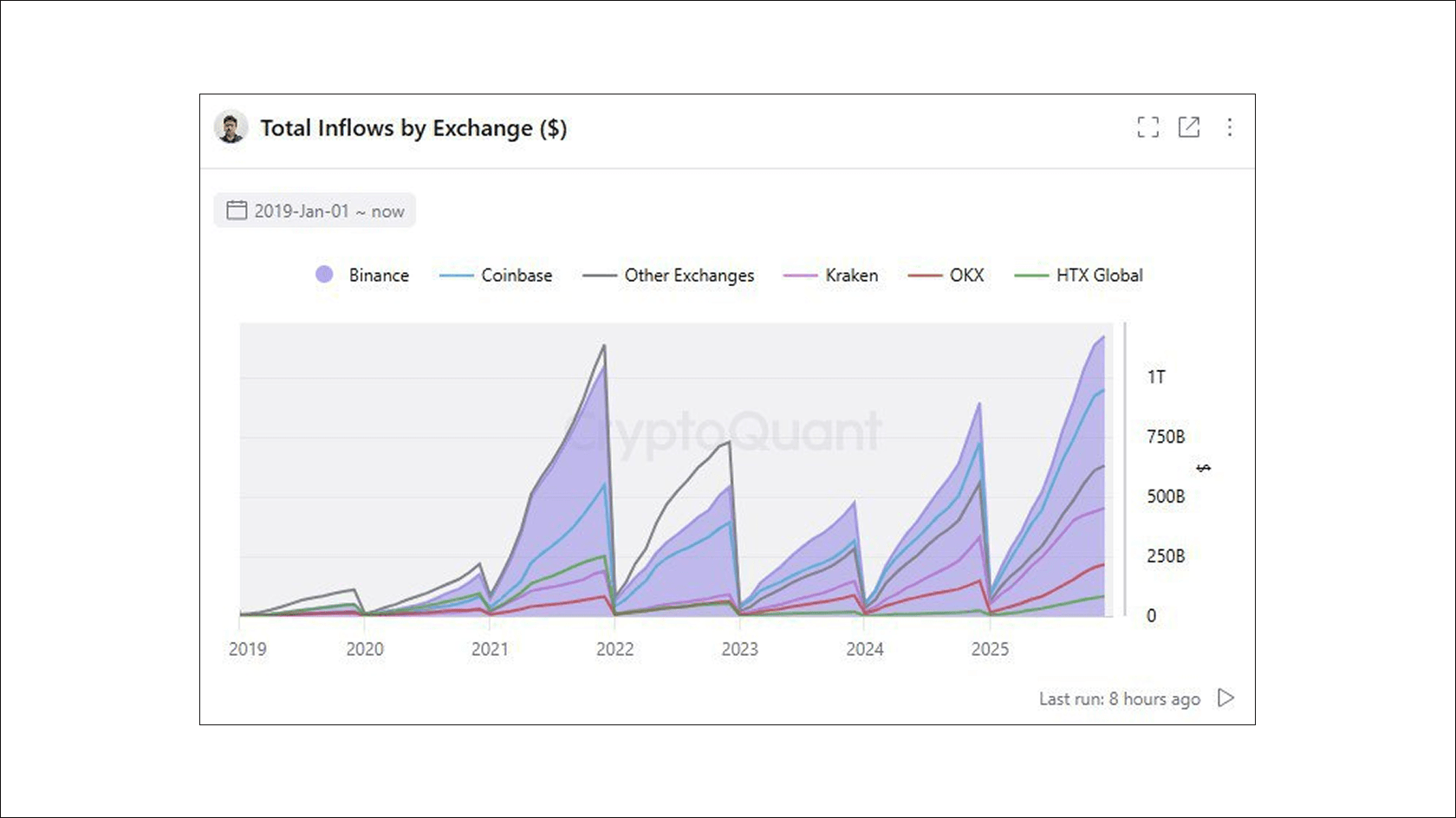

Deposit statistics confirm both institutional and retail interest. Crypto asset inflows to Binance addresses totaled a record $1.17 T, showing a 31% year-over-year increase. The platform outperformed all competitors in incoming liquidity, acting as the main entry point for fiat and stablecoin capital into the crypto economy.

Read also:

- How Hyperliquid Steals Traders From Binance (The $2B Secret Formula)

- Why Smart Gen Z Traders Never Touch Binance (The Safer Alternatives)

This post is for informational purposes only and does not constitute advertising or investment advice. Please do your own research before making any decisions.

0