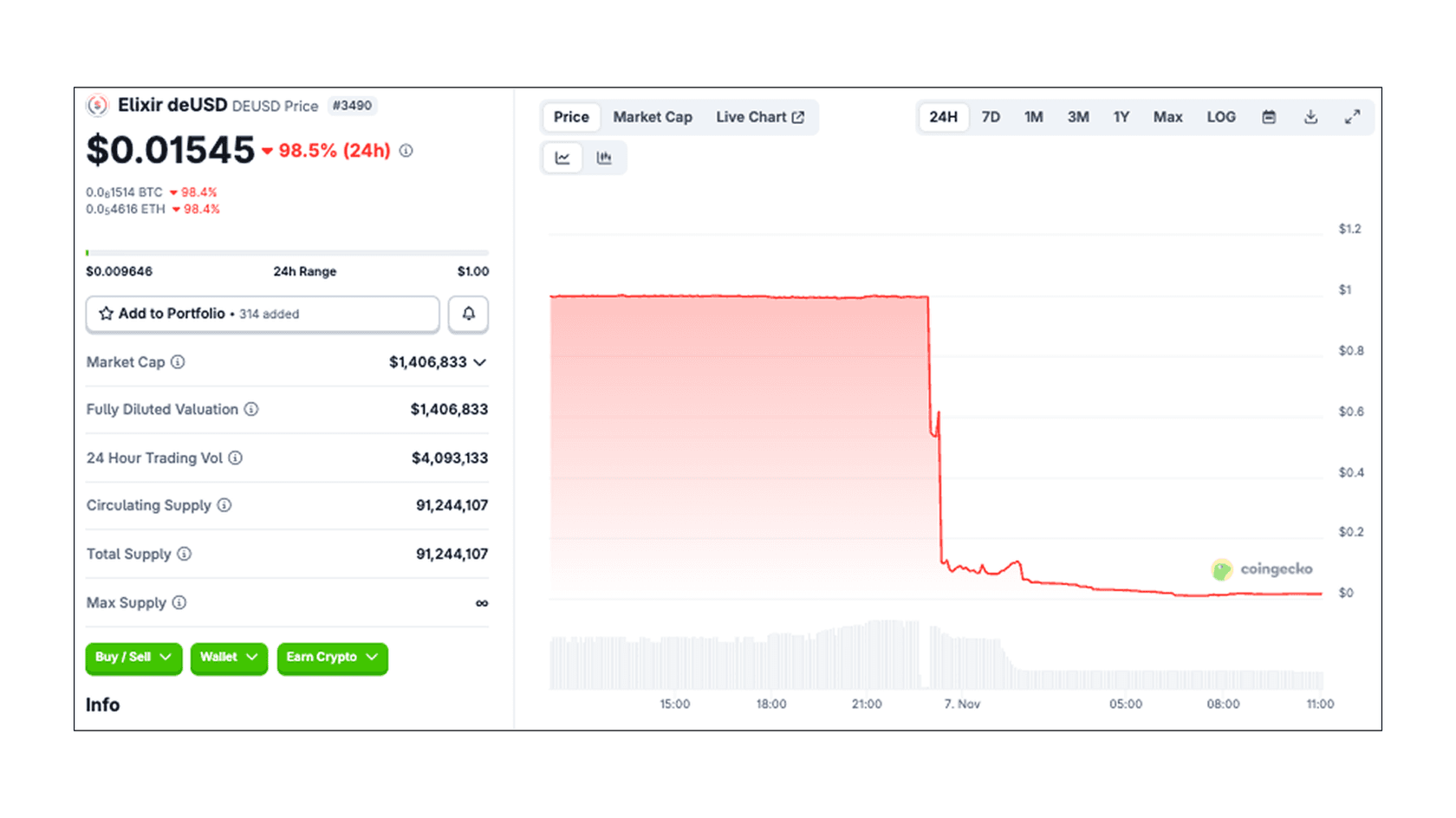

On November 7, analytics platform PeckShieldAlert reported a 98% plunge in the value of the deUSD stablecoin. The Elixir-linked asset lost its dollar peg after a chain reaction triggered by the collapse of DeFi project Stream Finance.

- ecosystems

- news

- 07 Nov 25

Stablecoin deUSD Crashes 98% Following Stream Finance Collapse

Elixir shuts down the project and promises to compensate holders in USDC.

0

- rating +26

- subscribers 113

Elixir announced the termination of the deUSD project and disabled the token’s issuance and redemption infrastructure. The team said redemptions had already been processed for 80% of holders, with remaining users to be reimbursed in USDC. It also warned against any further purchases of deUSD, stating that the stablecoin is now entirely worthless.

The collapse followed Stream Finance’s decision to halt operations after an external fund manager reported a $93 M loss. The protocol held debts exceeding $285 M, including more than $68 M owed to Elixir. Stream had used deUSD as collateral for its own stablecoin, xUSD, which also crashed after the losses were revealed and now trades below $0.20.

Elixir clarified that it remains the sole creditor of Stream entitled to full redemption at $1 per token and continues liquidating positions alongside Euler, Morpho, Compound, and other decentralized lenders. The team expressed confidence that obligations would be met on a 1:1 basis.

Amid the Stream ecosystem crisis, several DeFi protocols took precautionary steps to contain potential contagion. Aave founder Stani Kulechov (Stani.eth) announced that risk management firm Gauntlet had temporarily paused withdrawals from Compound to prevent possible bad debt related to deUSD’s collapse.

The deUSD crash sent shockwaves through the DeFi sector and stands as one of the largest failures among synthetic stablecoins in 2025.

This post is for informational purposes only and does not constitute advertising or investment advice. Please do your own research before making any decisions.

0