A rocky November may have been exactly what the market needed. Coinbase Institutional’s latest report identifies a total reset in the derivatives sector. With speculative froth gone and open interest stabilized, the risk of cascading liquidations heading into the holidays is significantly lower.

Massive Capital Outflow

November data confirms a bullish capitulation. Open interest across BTC, ETH, and SOL futures dropped 16% month-over-month. Sentiment also took a hit from spot ETF outflows: Bitcoin funds shed $3.5B, while Ethereum products saw $1.4B exit.

Perpetual funding rates flagged peak panic. During the sell-offs, funding dropped two standard deviations below the 90-day average. The market was deeply oversold, a condition that historically precedes a local reversal.

Structural Reset

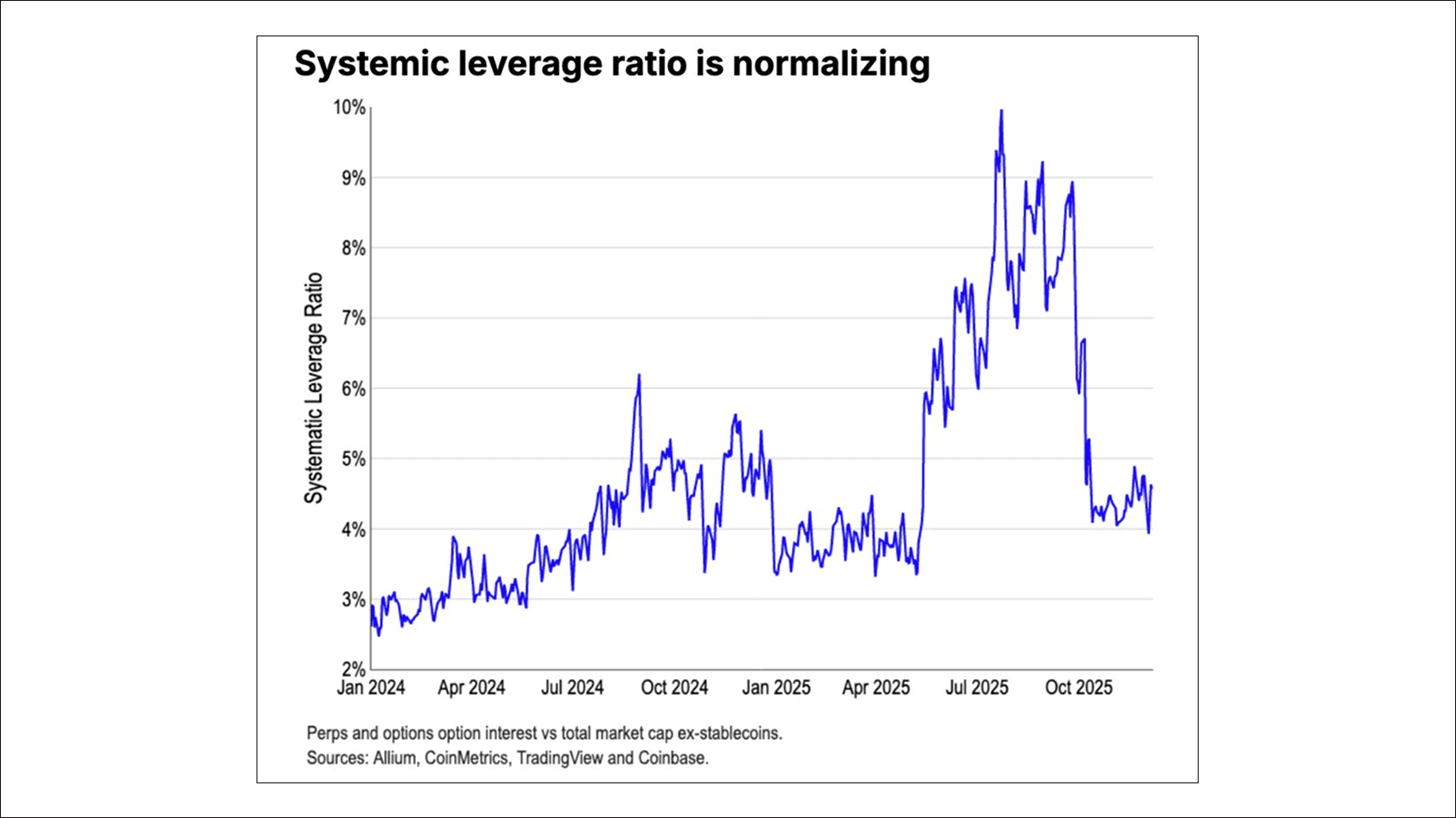

The systemic leverage ratio offers the clearest signal of normalization. This metric tracks purely speculative positioning relative to real market cap.