News

- nft

- news

- 12 hours

OpenSea Integrates Gaming Token POWER as Payment Method

Marketplace users can now buy NFTs using rewards from Web3 games without intermediate conversion into Ethereum or stablecoins.

0

- blockchain&beyond

- defi decrypted

- news

- 13 hours

Securitize Launches Trading of Real Public Company Shares on Ethereum

The SEC-registered transfer agent connects traditional equity with Web3 infrastructure, ensuring full investor protection.

0

- blockchain&beyond

- news

- 14 hours

Binance Dominates 2025 Market Liquidity — CryptoQuant

Spot volume exceeded the nearest rival fivefold, while derivatives doubled OKX figures amid record capital inflows.

0

- futureproofed

- blockchain&beyond

- news

- 15 hours

Charles Edwards Predicts Bitcoin Crash Below $50,000 Due to Quantum Threat

The Capriole Investments founder is confident: without an urgent network update by 2028, the market faces an implosion that makes the FTX scam look like a “cakewalk.”

0

- blockchain&beyond

- nft

- news

- 16 Dec 25

Pudgy Penguins Buys Las Vegas Sphere Ad Space for $500,000

The NFT collection’s Christmas promo targets an audience beyond the crypto market.

0

- blockchain&beyond

- news

- 16 Dec 25

US Senate Delays Crypto Market Reform Until 2026

The industry will not see unified crypto regulation this year. The Senate Banking Committee scrapped December hearings amid a budget crisis and ethical concerns over the Trump family’s multi-billion dollar crypto windfall.

0

- blockchain&beyond

- defi decrypted

- news

- 16 Dec 25

MetaMask Adds Bitcoin Support

Bitcoin can now be managed without third-party extensions.

0

- blockchain&beyond

- nft

- news

- 16 Dec 25

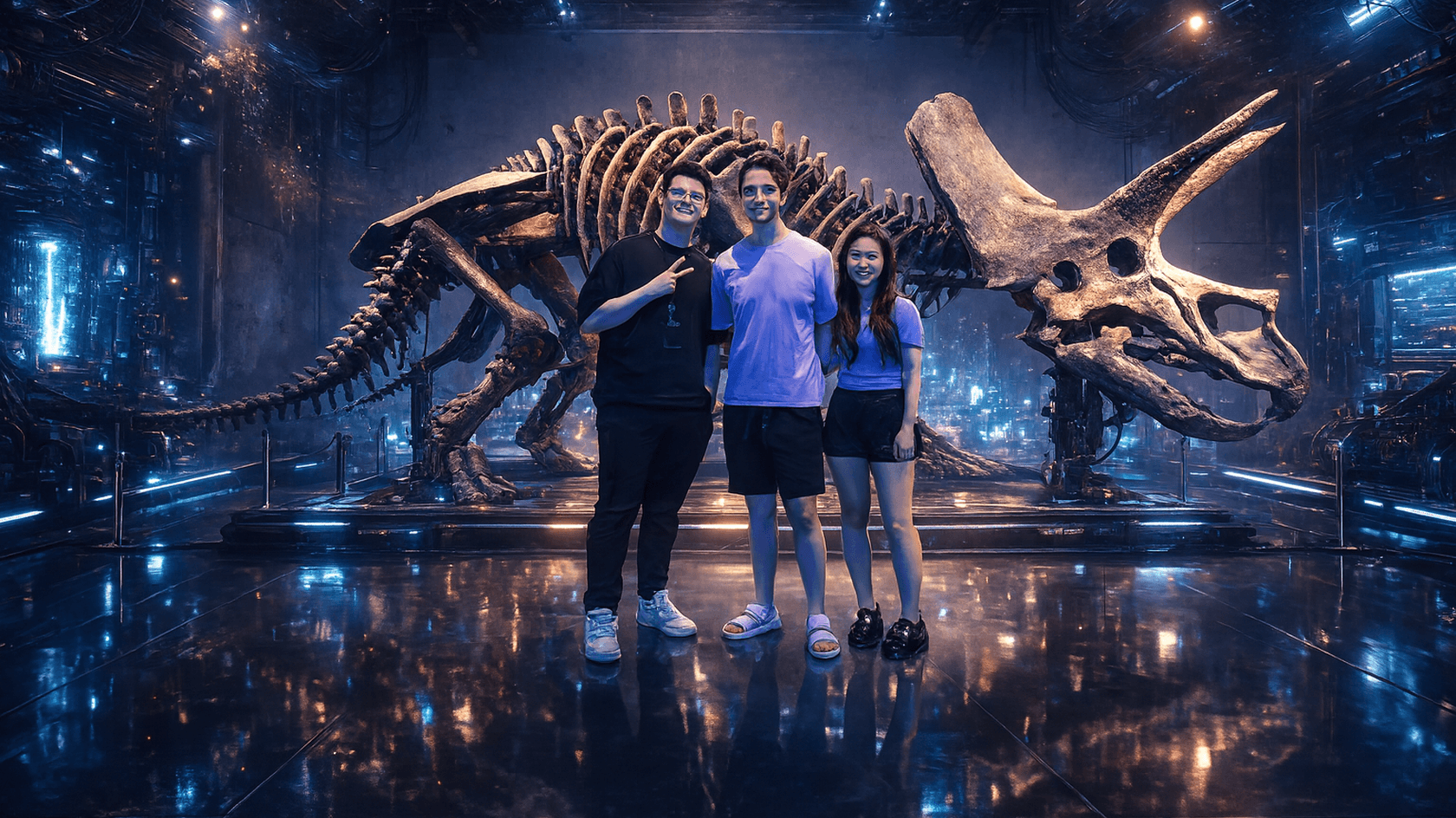

Crypto Millionaires Move from NFTs to Antiques — Bloomberg

Wintermute Co-Founder Paid $5 M for a Triceratops Skeleton, Signaling a Trend: Investors Seek Hard Assets Outside the Blockchain.

0

- blockchain&beyond

- news

- 15 Dec 25

Musk Becomes First Person in History With $600B Net Worth

SpaceX valuation skyrockets to $800B, turning the space venture into Musk’s top asset on the road to the first trillion.

0

- blockchain&beyond

- news

- 15 Dec 25

Analyst Eyes $40,000 Bitcoin Drop as Macro Landscape Shifts

The macro strategist sees gold as a superior hedge in the current climate and flags quantum computing risks for the crypto market.

0