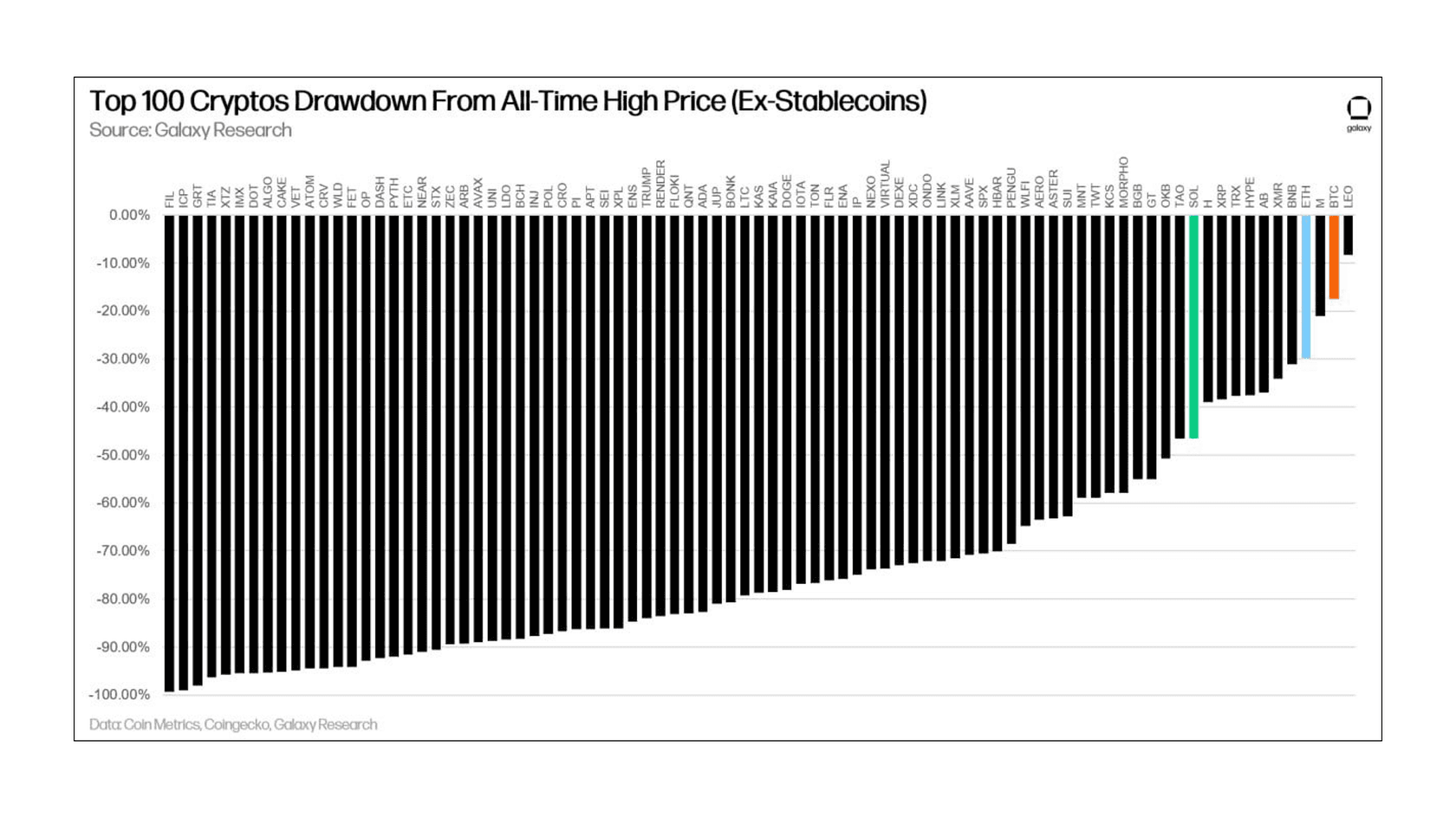

Seventy-two of the 100 largest cryptocurrencies by market capitalization (excluding stablecoins) have lost 50% or more of their value compared to their previous all-time highs.

- ecosystems

- news

- 06 Nov 25

72 Cryptocurrencies From the Top 100 Have Fallen More Than 50% – Galaxy Research

According to Galaxy Research, the crypto market has entered a period of major revaluation. Investors are shifting away from high-risk assets toward BTC and ETH, while the Fear & Greed Index is dropping to yearly lows.

0

- rating +26

- subscribers 113

The chart shows that most bars representing individual cryptocurrencies fall well below the –50% mark, indicating a deep and widespread correction in the altcoin segment.

This data reflects an extended correction phase that took hold in the crypto market by late 2025, despite the strong growth recorded the previous year.

At the time of publication, the market is experiencing a sharp decline and has effectively entered a bear phase, marked by drops of more than 20% from recent peaks.

Bitcoin, which reached a new all-time high of around $126,000 in early October 2025, quickly corrected and briefly dipped below $100,000. Its decline currently stands at about 20–22% from its record peak.

Ethereum has also seen a steep drop, falling roughly 36% from its highs.

Overall market sentiment, according to the Fear & Greed Index, has plunged into “Extreme Fear,” signaling panic and widespread selling.

Analysts have linked the downturn to several factors:

- Concerns over inflated valuations;

- Liquidations of leveraged positions following sharp price swings (such as the $19 B liquidation in October);

- Large-scale sell-offs by crypto whales;

- Macroeconomic developments, including statements from the Federal Reserve and major banks;

- Geopolitical events, such as Trump’s tariff-related tweet that triggered the October crash.

The Galaxy Research report highlights that while major cryptocurrencies like BTC and ETH suffered significant but relatively moderate declines (around 20–36%), most altcoins in the top 100 were hit much harder, losing more than half of their value.

This pattern is typical of a bear market phase, when capital exits riskier assets in favor of more stable ones (BTC, ETH) or leaves the market altogether.

Crypto analyst and weRate co-founder Quinten Francois noted that after such a drop, many coins may never return to their previous highs.

“Simple math, harsh reality for many of us. If an asset falls 30–50%, there’s a chance it may never recover. A 50% drop requires a 100% gain just to break even,” he wrote.

This post is for informational purposes only and does not constitute advertising or investment advice. Please do your own research before making any decisions.

0